- Guide to Contemporary Art

Get Your Free Guide on Art Investment

Why Invest in Art?

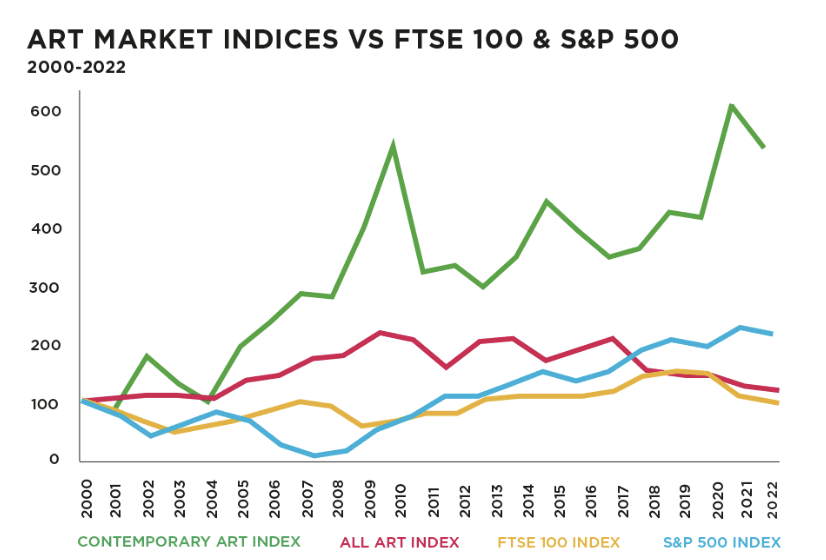

Art is transformative. Not only does it change the way we think and feel, it can also bring big financial rewards. With a $1.7 trillion global marketplace, art is a profitable investment that consistently outperforms other asset classes.

Art has several intrinsic advantages, including low maintenance costs, portability, low volatility, hedging possibilities and the ability to increase in value. Furthermore, the unique interplay between art’s cultural and financial value results in high investment returns that remain stable, and can even be fueled by wider financial turmoil or turbulence.

407%

85%

42%

Contemporary art has outperformed the FTSE 100 by 407% between January 1st 2000 to December 31st 2022.

ARTPRICE REPORT 2022 VS FTSE 100 INDEX 2000-2022

85% of Wealth Managers recommended including art in

a balanced investment portfolio.

DELOITTE ART AND FINANCE REPORT

The average price of a Contemporary work sold at auction

in 2022 increased by 42.7% compared to the previous year.

ARTTACTIC

Partners Featured in

Art is a global commodity. It can be bought and sold between collectors anywhere on earth, making it a truly worldwide market. With the long-term, worldwide trend of increasing wealth, alongside a growth in knowledge around Art, a much larger community has started to be interested in collecting and investing in the market.

An investment in Art provides an existing investment portfolio with further balance, and exposure to new growth markets. The investment grade art market, has outperformed all comparable asset classes over the last decade. Since 1950 the Art market has averaged returns between 4.20% – 11.30% Per Annum.

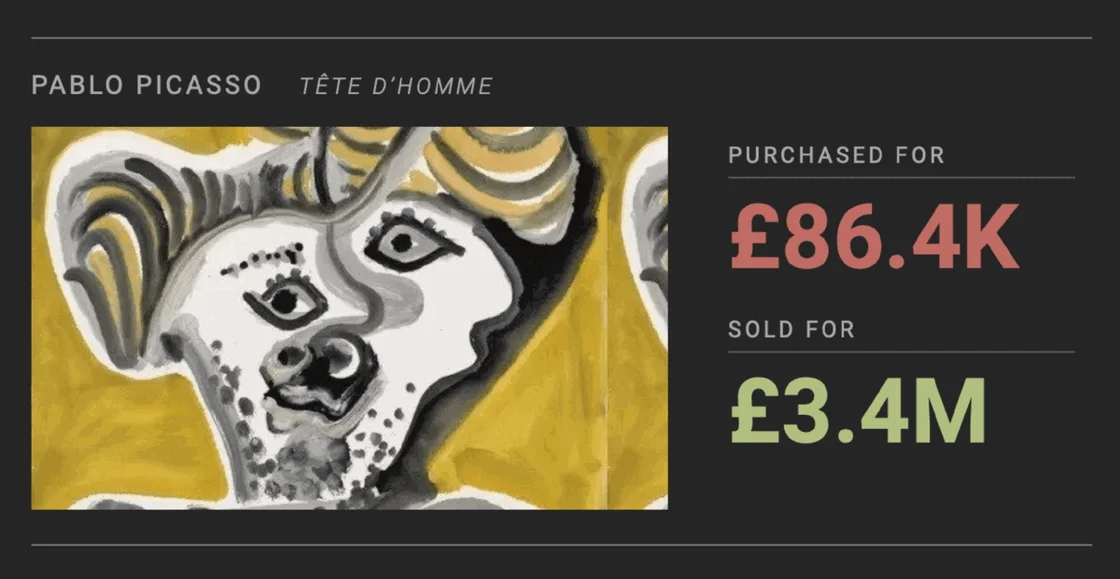

141% ROI

With the long-term, worldwide trend of increasing wealth, alongside a growth in knowledge around Art, a much larger community has started to be interested in collecting and investing in the market.

$5.8 BN

Between the 1st June 2019 and 30th June 2020 the average percentage profit achieved by our clients was 25.2%. With full asset ownership, your funds are secured against a tangible asset with an inherent value.

The Process

CONSULTATION

Once you have submitted your details, your dedicated Art Advisor will provide an art investment consultation free of charge to establish your budget, outline your preferences, including your risk appetite, and answer any questions you may have.

PORTFOLIO MANAGEMENT

Your Advisor will prepare a bespoke investment proposal comprised of works that are most likely to achieve your investment goals, keep you up to date with art market news and performance, and inform you of new opportunities that will complement your existing portfolio.

DELIVERY OR STORAGE

When you have started building your art portfolio, you can choose whether to have the artwork hung at home or in the office. Alternatively, we can arrange storage with one of our specialist suppliers. We will make the relevant arrangements based on your preferences.

RETURN ON INVESTMENT

Your advisor will get in touch when it is a good time to sell your artwork based on current market trends, demand for individual artists and recent sales. Once you have agreed to sell, our partners will market the artwork at the agreed price.

- Guide to Contemporary Art

Get Your Free Guide on Art Investment

Frequently Asked Questions